SBI External Benchmark Linked Lending Rate

SBI has not yet revised the minimum interest rate on home loans in September. As per SBI’s website, with effect from August 15, 2022, the bank’s EBLR is 8.05%+CRP+BSP. RLLR is 7.65%+CRP.

However, risk premium will be charged on the basis of credit score. This means a borrower with a credit score above 800 will now pay a minimum rate of 7.55 per cent under a regular home loan.

For applicants who have a credit score of 800 or above, the minimum interest rate on regular home loans is 8.05 percent. In this case the risk premium is 0. The risk premium is based on the CIBIL score; The risk premium rate increases with a lower credit score.

A credit score of 750 to 799 will result in an 8.15 percent interest rate with a risk premium of 10 basis points. Women borrowers will get a reduction of 0.05 percent in the interest rate.

Once the reset date approaches, borrowers will be forced to pay higher interest rates, i.e. higher EMIs, or their loan tenure will be extended if there is room for it.

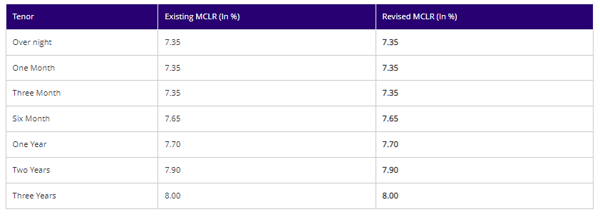

SBI marginal cost of funds based lending rates

SBI has revised the Marginal Cost of Funds Based Lending Rates (MCLR) till September 15, 2022.

SBI Benchmark Prime Lending Rate BPLR

The Bank Benchmark Prime Lending Rate (BPLR) was increased to 13.45% as on 15.09.2022.

SBI Base Rate

state Bank of India has revised its Base Rate to 8.70% pavf 15.09.2022 from 8% earlier. The rates were earlier hiked on June 15, 2022.

SBI Processing Fee Waiver

State Bank of India has announced a 50-100% reduction in housing loan processing expenditure. This promotion is available from 1 August 2022 to 30 September 2022.

According to the SBI website, the bank has waived 50% of the basic processing charge for residential and home loans (other than takeovers). The bank has removed the minimum processing cost for home loan takeover and associated top-up.

Read also:

SBI waives processing fees on home loans for this period