Many banks offer recurring deposits at attractive rates Rate of interest,

For RD, a person has to deposit a certain amount of his income every month for a predetermined period. After maturity, the principal amount is returned, along with the interest received.

Here is a quick comparison between , and offers the best interest rates for recurring deposits.

Post Office Recurring Deposit Interest Rates

India Post Office offers recurring deposits at an interest rate of 5.8 per cent for a fixed tenure of 5 years (60 months) for the July-September quarter of the current financial year. Whereas it can be extended for another 5 years by submitting the application in the concerned post office. The interest rate applicable during the extension will be the same as when the account was opened for the first time.

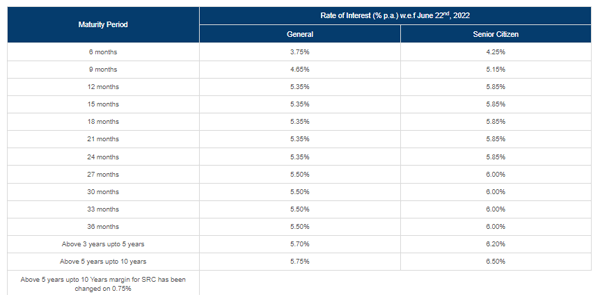

HDFC Bank Recurring Deposit Interest Rates

HDFC Bank offers RD facility from 6 months to 120 months, with interest rates ranging from 3.75 percent to 5.75 percent. The rate offered by HDFC Bank for tenures of 5 years or 60 months is 6.70 per cent.

ICICI Bank Recurring Deposit Interest Rates

ICICI Bank recurring deposit The facility is available for a period ranging from six months to ten years. The interest rate offered by ICICI Bank for RDs with tenures of three to five years is 5.70 per cent, while the rate above that is 5.75 per cent.

SBI Recurring Deposit Interest Rates

state proposals RD interest rates Which are same as fixed deposit rates for minimum 12 months and maximum 120 months. SBI offers 5.50 per cent interest on maturity of 5 years or more and 5.45 per cent on maturity of 3 to 5 years.