Most NRIs open NRE Account To benefit from unlimited money repatriation and its liquidity. If you want to send money without any restrictions then opening an NRE account is an option.

As per the RBI circular, “An NRE Rupee account can be opened in the form of Current, Savings or Fixed Deposit.” Local payments can be made freely from NRE accounts. Since this account is maintained in Rupee, the depositor is exposed to exchange risk. NRIs/PIOs have the option to credit current income in their Non-Resident (External) Rupee Accounts, provided the Authorized Dealer is satisfied that the credit represents the current income of the non-resident account holders and income-tax has been deducted/provided for the same. ”

NRIs can open current, savings, recurring and fixed deposits. Here are the top banks offering interest rates on NRE fixed deposits.

SBI NRE Fixed Deposit Interest Rates

If the deposit amount is withdrawn from NRE Fixed Deposit before one year, no interest is paid. SBI offers interest rates between 5.30 per cent to 5.50 per cent for tenures between one year and 10 years for balances below Rs 2 crore.

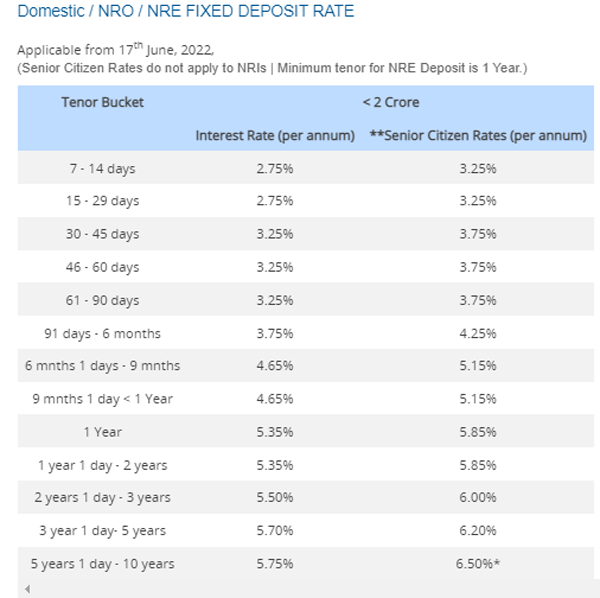

HDFC Bank NRE Fixed Deposit Interest Rates

The minimum tenure for NRE deposits is 1 year. HDFC Bank offers interest rates ranging from 5.35 per cent to 5.75 per cent for tenor of one to ten years for accounts below Rs 2 crore.

ICICI Bank NRE Fixed Deposit Interest Rates

No interest will be paid if the deposit is withdrawn before the tenure of one year. For tenors ranging from one to ten years, ICICI Bank offers interest rates ranging from 5.35 per cent to 5.75 per cent.

Please note that NRE fixed deposits are not eligible for the additional 0.5 per cent p.a. interest rate that is offered to older people on fixed deposits.

Yes Bank NRE Fixed Deposit Interest Rates

Offers interest rates ranging from 6% to 6.50% for tenors ranging from one to ten years. According to the Yes Bank website, “If FCNR, NRE FD and RFC FD are withdrawn before the completion of 12 months, no interest is payable.” The additional interest rate payable on Fixed Deposits to Senior Citizens is not applicable to NRE and NRO Fixed Deposits.”

Benefits of NRE Account

NRE accounts are tax free. Both the balance and interest deposited in these accounts are tax-free. The advantage of an NRE account is that it has high liquidity and enables complete repatriation to the NRI’s home country when required. With NRE account you can freely transfer money to any foreign account.