One of the transactions that many of us do online is to transfer money. UPI, Oil, RTGS Allow us to transfer money online easily.

As per Reserve Bank of India (RBI) notification dated June 11, 2019, “It has been decided that with effect from July 1, 2019, processing fee and time-varying charges for outward shall be levied on banks by Reserve Bank of India (RBI) Transactions done using the RTGS system, as well as the processing charges levied by reserve Bank of India Transactions processed in the NEFT system will be exempted by the Reserve Bank.

Further, with effect from January 01, 2020, banks have been advised not to charge their savings bank account holders any charges for NEFT fund transfers initiated online as per RBI.

However, banks charge a fee for the transactions done at the branch level. Here are the NEFT and RTGS fees charged by banks.

For NEFT, RTGS transactions done at bank branches,,, and ()

What is National Electronic Funds Transfer (NEFT)?

According to ICICI Bank’s website, “National Electronic Funds Transfer (NEFT) system is an electronic payment system that allows direct one-to-one payments across the country. Using this service, you can transfer electronically from any bank branch. Any person who has an account with any other bank branch in the country who participates in the NEFT scheme. You can also use internet banking and mobile banking to make NEFT transfers.”

What is Real Time Gross Settlement (RTGS)?

According to RBI, “The acronym ‘RTGS’ means Real Time Gross Settlement, which can be explained as a system where there is continuous and real-time settlement of fund-transfer, on an individual transaction basis. But on a transactional basis (without netting). ‘Real Time’ means the processing of instructions at the time of receipt, ‘Gross Settlement’ means that the funds transfer instructions are settled individually.

Required details for doing RTGS, NEFT

The sender has to provide the following details:

- amount to be remitted

- Beneficiary Customer Account Number

- beneficiary bank name

- Beneficiary Customer Account Name

- sender of information to the recipient, if any

- IFSC of Beneficiary Branch

- Sending customer’s mobile number/email id

- purpose.

Fee for NEFT and RTGS

SBI RTGS, NEFT Fee

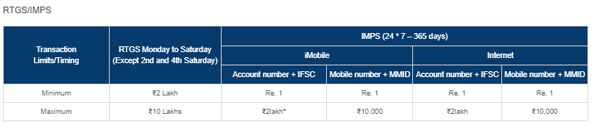

The minimum amount for RTGS is Rs 2 lakh, and for NEFT is Rs 1, and there is no maximum limit for both.

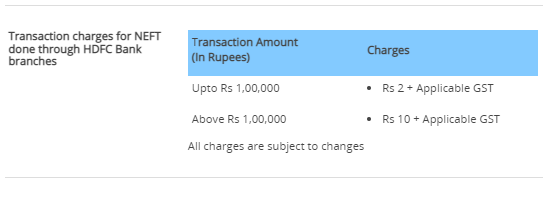

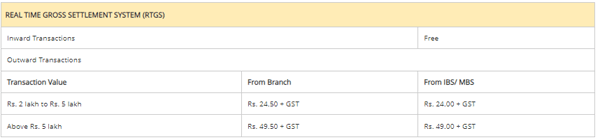

HDFC Bank RTGS, NEFT Charges

According to the HDFC Bank website, “At the time of adding a new beneficiary, you can make a maximum transaction of Rs 50,000/- (including complete or unsuccessful attempt) during the first 24 hours.” Note transaction charges for RTGS from HDFC Bank branches is Rs 15 + applicable GST

ICICI Bank RTGS, NEFT charges

The below mentioned transaction charges are applicable for NEFT transfers that are initiated through ICICI Bank branches.

ICICI Bank NEFT charges

ICICI Bank RTGS charges

Punjab National Bank (PNB) NEFT, RTGS Charges

PNB RTGS Fee

PNB NEFT Fees

Difference Between RTGS and NEFT

NEFT is an electronic fund transfer system that processes batches of transactions received up to a specified time frame. In contrast, transactions are processed continuously throughout the day in RTGS on a transaction-by-transaction basis.