Paytm, formally known as One97 Communications Limitedhas signed the world’s largest asset manager BlackRock and CPPIB along with Singapore and Abu Dhabi-based sovereign wealth funds as anchor investors for an IPO worth Rs 183 billion ($2.46 billion) next week. According to Bloomberg News, $1.1 billion in sales to Cornerstone investors saw demand 10 times higher than the shares offered.

The Indian online payments pioneer had tremendous innovation five years ago. When Prime Minister Narendra Modi suddenly frozen 86 percent of the country’s currency in November 2016, in a failed bid to freeze misappropriated cash, the budding app, whose name is shorthand for “pay via mobile,” , has won millions of new customers overnight. Founder Vijay Shekhar Sharma could not hide his glee. Warren Buffett’s Berkshire Hathaway Inc joins Masayoshi Son’s SoftBank Group Corp and Alibaba Group Holding Ltd as investors in the startup.

it was then. India’s technology landscape has evolved so rapidly since 2016 that most businesses nowadays pay nothing to receive customer payments on smartphones. And the pricing pressure isn’t going to ease, except that merchants will want to pay even less for add-on services, such as reconciling accounts and handling returns and refunds.

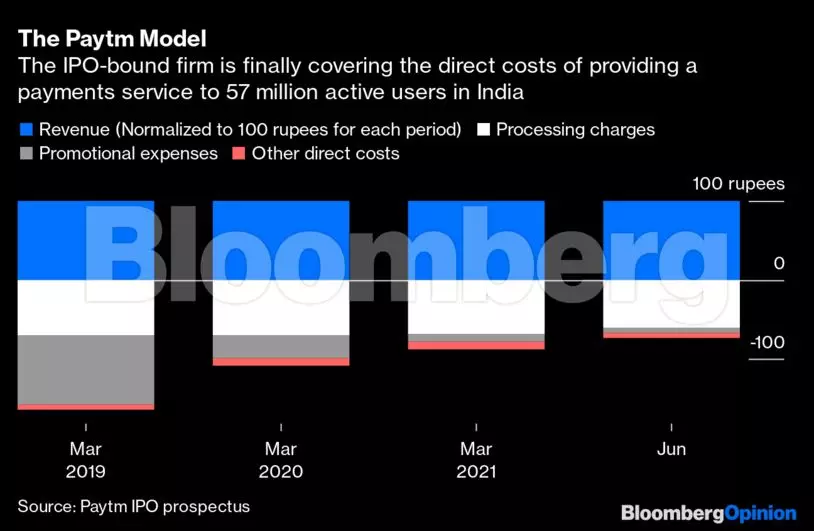

When there weren’t 57 million unique monthly users today, Paytm spent Rs 162 in direct costs to achieve a revenue of Rs 100 – not counting overheads like salaries and brand-building. Of this, Rs 70 was spent on processing payments and another Rs 86 on cash-backs and other inducements. “You can’t have a business that says, ‘Pay Rs 500 bill and get Rs 250 cash-back,'” says Aditya Puri, then chief executive officer HDFC Bank LimitedIndia’s largest lender by market value had said in 2017 that e-wallets have no future.

However, in its most recent quarter, Paytm ended with a surplus of Rs 27 on the same Rs 100 revenue. Thanks to the additional overheads, it’s not a benefit yet – but it’s getting closer. HDFC Bank is now a partner of Paytm.

The economics are improving, even as phone wallets have become a commodity. The underlying technology, which Paytm uses to compete against Alphabet Inc.’s Google Pay and Walmart Inc.’s PhonePe, is a shared utility that anyone can commercialize. So while Paytm handles the equivalent of about $80 billion in payments annually to 22 million merchants, its “take rate” for translating transactions into revenue is just 0.6%.

But it is this very competitive nature of the payment game that encourages more merchants in smaller cities and towns to accept cashless devices, eschewing expensive cards and contactless systems such as PayPal Holdings Inc., which have fueled the Indian domestic landscape. has been completely abandoned.

bloomberg

bloomberganchor investor interest Paytm IPO The Indian model of digitization is the biggest validation ever: From payments to health care, an open market protocol – running on top of a public utility – can be a viable alternative to proprietary platforms and predatory pricing. What a firm can lose in charging rates on individual transactions outweighs the gains from handling billions of them.

A low-margin, high-volume business can create its own data moat. Since most of India’s retailers are too small and too informal to otherwise be able to access credit, digital payments act as valuable – and often the only – informational collateral. The money-making opportunity lies in giving credit to mom-and-pop stores based on their digital cash-flow trail. As Paytm founder Sharma told BloombergQuint, “India’s GDP will not grow because payments are digital, but because payments are digital enabled lenders to give credit.”

Consider the behavior of the firm’s current and future competitors to see why that might be right.

Ekta Small Finance Bank, a brand new, digital-first institution, this week emerged from the ashes of another payments scam-tainted cooperative lender with BharatPe.

Like Paytm, as one of its two identical owners. It could be a predictable diversification: The wafer-thin margins on which smaller retailers operate in emerging markets like India can’t sustain a pure-play payments business like Visa Inc. or PayPal. If you can’t lend them money then there will be little benefit from giving shoppers a QR code to receive money.

But again, consider the opposite maneuver. Bajaj Finance LimitedIndia’s top consumer lender, in an investor presentation, said it has roped in over 3 million customers for its wallet. It is now applying for a payment aggregator license that will enable customers to settle bills of merchants without the need for arbitration by third party apps. If the whole purpose of making payments is to lend, why would a profitable financier want to enter a potentially money-losing business?

For fear of being overtaken by BharatPe and Paytm, pursue it. BharatPe is a co-owner of a bank. Paytm is stuck with a 49% stake in a so-called payments bank, which is not allowed to lend and can only accept deposits below a certain level.

The next step for Paytm and its payments bank is to amalgamate into a full-fledged, unrestricted lender, credit-card issuer and deposit taker, and flex its balance sheet like the digital-only KakaoBank Corp in South Korea. That’s where the pot of gold lies, and BlackRock may have understood it better than analysts moaning over a transaction not translating into revenue. This is a feature, not a bug.