There are several different types of savings accounts, each with a specific function depending on the type of account. Most of the top public sector banks and private sector lenders levy penalty on their customers for not maintaining the monthly average balance in their savings accounts.

The penalty depends on factors such as the location of the branch and the amount held in the account. However, the country’s largest public sector bank,

(ii) has waived off the penalty for non-maintenance of the average monthly balance.

compared to minimum balance requirements by SBI, and

State Bank Of India

In August 2020, SBI said it would not charge savings bank account holders for failing to maintain the required minimum balance.

HDFC bank

For HDFC Bank customers, the service, transaction charges will be applicable in the current month based on the AMB created in the account in the previous month.

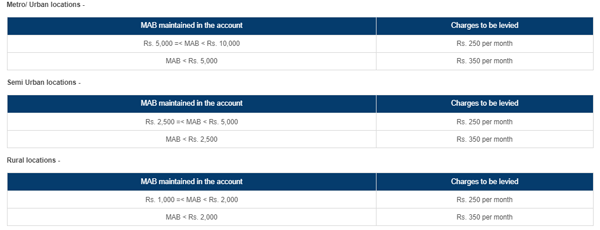

HDFC Bank customers of Metro branches are required to have an average monthly balance (AMB) of Rs 10,000 or a fixed deposit of Rs 1 lakh for a minimum tenure of 1 year and 1 day. It is applicable from 1st July 2022.

According to the HDFC Bank website, HDFC Bank customers from semi-urban branches need a fixed deposit of AMB Rs 5,000 or Rs 50,000, and rural branches require a fixed deposit of AQB Rs 2,500 or Rs 25,000.

ICICI Bank

The minimum average monthly amount for regular savings accounts of the bank is Rs 10,000 for metro areas, Rs 5,000 for semi-urban areas and Rs 2,000 for rural areas.

charges to be levied