New Delhi: Your car insurance premium It may soon be dictated by how much and how well you drive. Insurance Regulatory and Development Authority of India (break up) has allowed insurers to launch Pay-As-You-Drive Motor Insurance Profit and quality premium policies driving,

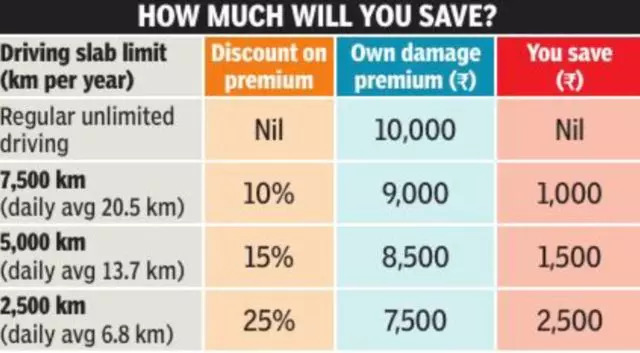

Pay-as-you-drive policy allows buyers to set a mileage limit for their car and offers them a discount on the normal premium. Lower the limit, higher will be the exemption on normal premium. The insurance is valid only to the extent chosen by the buyer. An insurance company offers three slabs of 7,500 km, 5,000 km and 2,500 km.

Insurance companies may also offer discounts based on the quality of driving. A telematics device has been installed in the car to monitor the vehicle condition and the user’s driving habits. This data is then interpreted to discount careful drivers. It can also penalize negligent and careless drivers.

These developments are good news for those who have multiple vehicles or who are not driving a lot due to the COVID restrictions. If their vehicles are not being heavily used, they will not have to pay the full premium. “The introduction of these options will help in increasing the reach and reach of the much needed motor own damage cover in the country,” IRDA said in a statement.

However, the discount offered on premium is not very exciting (see table). If you choose the 7,500 km slab, you get only 10% discount on the regular premium. Keep in mind, the discount is applicable only on ‘Own Damage’ premium, and mandatory third-party premiums and other add-on covers are not affected.

The discount is a bit more attractive for the lower range of 2,500 km, but it works out to an average drive of less than 7 km in a day. Consider this before opting for a low slab policy.

The good news is that buyers can switch to a higher slab or even a regular unlimited policy if they are driving over the slab limit. But this upgrade should be done well ahead of time. It is not possible to upgrade after an accident or claim incident.

The installation of telematics devices also raises privacy concerns for the car owner. No doubt this will reduce the insurance premium, but this discount comes at a price. Go for it only if you are comfortable with the idea that the insurer will have 24×7 data on your car movement.

Pay while driving motor insurance cover: How premium will be charged

Pay while driving motor insurance cover: How premium will be charged

new offer

Insurance companies will soon offer vehicle owners analysis-based insurance that includes ‘pay as you drive’ policies and covers where premiums vary according to driving behaviour. The Times of India reported that companies have also been allowed to issue floater policies for multiple vehicles of the same owner.

what did irda say

The Insurance Regulatory and Development Authority of India (Irdai) said in a statement, “As a step towards facilitating technology-enabled cover, Irdai has offered technology-enabled coverage of Motor Own Damage (OD) cover to general insurance companies. concepts are allowed to be introduced.”

why was it done

According to the regulator, the advent of technology has created a constant momentum for the insurance fraternity to meet the interesting yet challenging demands of the millennium.

how will it work

“For example if you want to take a cover based on the number of kilometers driven by your vehicle, you can opt for this cover. With this circular, the insured can also buy an add-on motor cover on floater basis for multiple vehicles, be it four wheelers or two wheelers,” Bajaj Allianz Chief Technical Officer TA Ramalingam told TOI. He said the purpose of such a cover is to make motor insurance essentially more affordable, especially for customers who primarily opt for third-party covers only and overlook the benefits of OD covers.