many big banks including

and has increased its fixed deposit rates for amounts below Rs 2 crore.

During the time when banks cut FD rates, the government kept interest rates on small savings schemes like Post Office Fixed deposit unchanged. Even now, there has been no change in the interest rates on small savings schemes for the July-September quarter.

Now that the banks have started increasing the FD rates, have they caught up with the post office fixed deposit rates?

Bank FD vs Post Office TD

FD of one or two years: SBI offers a Rate of interest 5.3 percent for this term. Banks and ICICI Bank pay 5.35 percent interest. One and two-year POTD comes with an interest rate of 5.5 per cent for the July-September quarter.

FD of two to three yearsICICI Bank and HDFC Bank offer 5.50 per cent for FDs of 2-3 years, which is similar to post office fixed deposit interest rates. SBI offers 5.35 percent for this tenure.

FD of three to five years: For this year, POTD’s score is much higher than that of banks. The interest rate for the 5-year POTD for the July-September quarter is 6.7 per cent. HDFC Bank and ICICI Bank offer 5.7 per cent for FDs of 3-5 years, while SBI FDs of this tenure come with an interest rate of 5.45 per cent.

Here is a look at the full range of interest rates offered by ICICI Bank, HDFC Bank, SBI and POTD (till July 5, 2022).

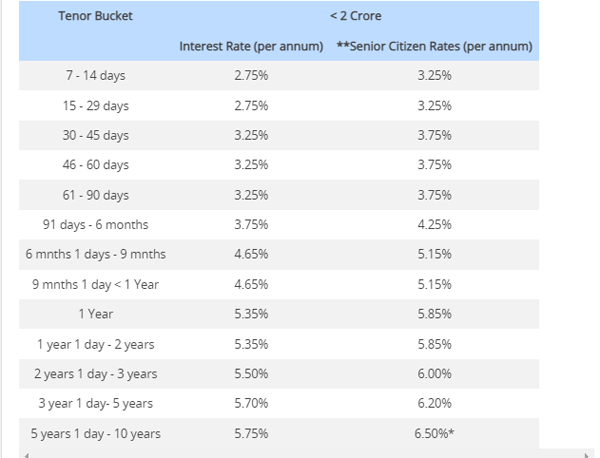

ICICI Bank

ICICI Bank offers interest rates ranging from 2.75 per cent to 5.75 per cent for tenures ranging from 7 days to 10 years.

HDFC bank

HDFC Bank offers interest rates ranging from 2.75 per cent to 5.75 per cent for tenures ranging from 7 days to 10 years.

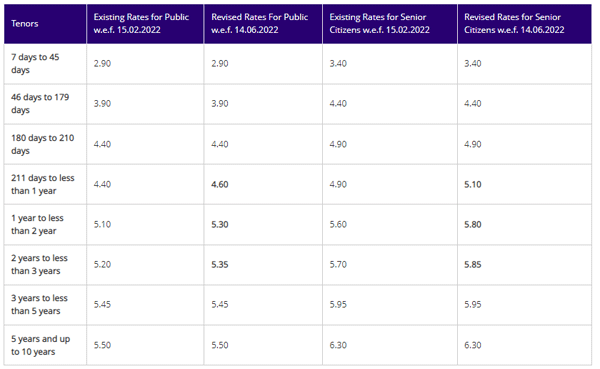

State Bank of India offers interest rates ranging from 2.90 percent to 5.50 percent for tenors ranging from 7 days to 10 years.

post office fixed deposit

Post office fixed deposits offer interest rates ranging from 5.5 per cent to 6.7 per cent for tenors ranging from one year to 5 years.